Specialist Insights: What You Required to Find Out About Credit Repair Providers

Specialist Insights: What You Required to Find Out About Credit Repair Providers

Blog Article

A Comprehensive Guide to Just How Credit History Repair Work Can Change Your Credit History

Comprehending the complexities of credit fixing is vital for any person seeking to boost their economic standing - Credit Repair. By resolving issues such as payment background and credit scores application, individuals can take proactive actions towards enhancing their credit rating. Nevertheless, the procedure is usually laden with misconceptions and possible pitfalls that can hinder progress. This guide will certainly brighten the key techniques and factors to consider necessary for effective credit report repair work, inevitably disclosing how these efforts can result in much more desirable economic possibilities. What continues to be to be discovered are the certain actions that can establish one on the course to an extra robust credit rating profile.

Comprehending Credit History

Understanding credit rating is essential for any individual looking for to improve their monetary health and gain access to much better loaning alternatives. A credit report is a numerical depiction of a person's creditworthiness, usually ranging from 300 to 850. This score is generated based on the info contained in an individual's credit rating report, that includes their credit rating, arrearages, repayment background, and kinds of charge account.

Lenders make use of credit history to analyze the threat connected with providing cash or extending credit history. Greater ratings suggest lower threat, often leading to more favorable car loan terms, such as reduced rate of interest and higher credit rating restrictions. Alternatively, reduced debt scores can cause greater rates of interest or rejection of credit score completely.

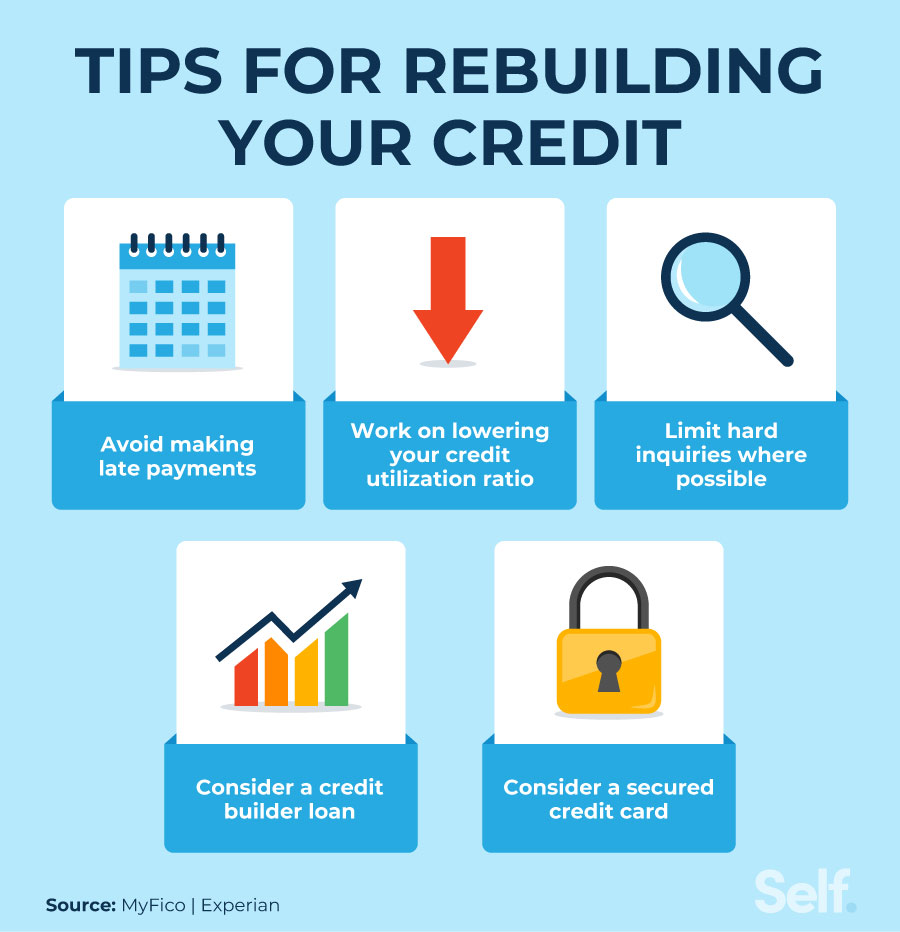

Numerous aspects affect credit rating ratings, including settlement history, which accounts for about 35% of ball game, adhered to by credit utilization (30%), length of credit report (15%), types of credit history in use (10%), and new credit history queries (10%) Understanding these variables can equip individuals to take workable steps to boost their scores, eventually enhancing their monetary possibilities and security. Credit Repair.

Usual Credit Issues

Numerous individuals deal with typical credit scores concerns that can impede their monetary progression and affect their debt scores. One common issue is late settlements, which can substantially damage credit scores ratings. Also a single late repayment can remain on a debt report for numerous years, impacting future borrowing potential.

Identification burglary is another severe problem, potentially leading to deceptive accounts appearing on one's credit history record. Dealing with these common credit scores concerns is essential to improving monetary health and wellness and developing a solid credit score account.

The Credit Report Fixing Process

Although credit report repair service can seem difficult, it is a methodical process that individuals can undertake to enhance their credit history and remedy mistakes on their debt records. The primary step involves acquiring a copy of your debt record from the 3 major credit bureaus: Experian, TransUnion, and Equifax. Testimonial these records thoroughly for mistakes or discrepancies, such as incorrect account information or outdated details.

As soon as errors are determined, the next step is to challenge these errors. This can be done by news calling the debt bureaus straight, offering documentation that sustains your case. The bureaus are required to examine these details conflicts within 1 month.

Maintaining a regular settlement background and handling credit scores use is also critical throughout this process. Checking your credit score regularly ensures ongoing precision and aids track enhancements over time, enhancing the efficiency of your credit rating fixing efforts. Credit Repair.

Benefits of Credit Report Repair Service

The advantages of debt repair expand much beyond just improving one's credit history; they can significantly impact financial stability and possibilities. By attending to mistakes and negative items on a credit rating report, people can enhance their credit reliability, making them much more attractive to lending institutions and banks. This improvement usually leads to far better rates of interest on fundings, reduced premiums for insurance policy, and increased chances of approval for bank card and home loans.

Furthermore, credit rating repair can facilitate accessibility to important services that call for a credit rating check, such as renting a home or acquiring an utility service. With a much healthier credit history profile, people might experience boosted self-confidence in their monetary choices, allowing them to make larger acquisitions or financial investments that were previously out of reach.

Along with concrete financial benefits, credit fixing promotes a sense of empowerment. Individuals take control of their monetary future by proactively handling their credit score, causing more informed selections and greater financial literacy. In general, the advantages of credit scores repair service add to a more steady financial landscape, inevitably advertising lasting financial growth and personal success.

Choosing a Credit Report Repair Work Service

Choosing a credit fixing solution requires mindful factor to consider to make sure that individuals get the assistance they require to enhance their economic standing. Begin by investigating potential helpful resources firms, concentrating on those with positive customer reviews and a tested record of success. Transparency is vital; a reliable solution needs to clearly detail their charges, timelines, and procedures ahead of time.

Following, confirm that the credit scores repair service follow the Credit history Repair Work Organizations Act (CROA) This government regulation shields consumers from deceptive practices and collections guidelines for credit scores repair solutions. Prevent firms that make unrealistic pledges, such as assuring a certain rating increase or declaring they can get rid of all adverse things from your record.

In addition, consider the degree of client support offered. An excellent credit scores repair work service ought to give customized assistance, permitting you to ask concerns and receive prompt updates on your progress. Try to find solutions that use a comprehensive evaluation of your credit record and develop a personalized method customized to your certain scenario.

Eventually, selecting the right credit history fixing solution can cause substantial renovations in your credit rating, encouraging you to take control of your monetary future.

Verdict

To conclude, reliable credit rating repair methods can significantly improve credit report ratings by attending to usual issues such as late repayments and mistakes. A detailed understanding of credit report aspects, incorporated with the engagement of reputable credit history repair service solutions, helps with the settlement of adverse items and ongoing progression monitoring. Inevitably, the successful renovation of credit rating not only results in much better financing terms however likewise cultivates higher monetary opportunities and security, underscoring the relevance of positive credit administration.

By addressing issues such as repayment background and credit report use, individuals can take proactive steps toward boosting their debt ratings.Lenders utilize debt scores to assess the threat connected with lending money or prolonging credit score.An additional frequent trouble is high credit rating use, specified as the ratio of existing debt card balances to complete readily available credit rating.Although credit rating fixing can appear difficult, it is a systematic process that individuals can embark on to enhance their debt scores and fix errors on their credit scores records.Next, validate that the credit report repair work solution complies with the Debt Repair Work Organizations Act (CROA)

Report this page